Bond Issue Steps and Participants

Bond Issue Steps

- Feasibility Study and Finance Team – Decide if your project can be done through the Maricopa Contact IDA (Contact Us for help) and assemble finance team.

- Complete Application and Pay Fee – Currently, a $3,000 non-refundable fee is due with application.

- Inducement Resolution – Resolution of issuer indicating intent to issue bonds for benefit of project in specified amount. May not be applicable for Non-profit or Charter School Financings

- Publish TEFRA Notice and have Hearing– Notice of public hearing must be published at least 2 weeks prior to hearing date; must identify project and owner; and must specify maximum dollar amount.

- Obtain Bond Volume Cap – Annual Funding limit set by Federal Government for tax-free bonds (except for 501(c)(3) organizations).

- Draft Bond Documents – Generally done concurrently with above steps. Typically takes two to six weeks but can take longer.

- Government Approvals – Receive Maricopa County IDA Board approval, Maricopa County Board of Supervisor approval and Arizona State Attorney General signoff.

- Print and Mail Preliminary Official Statement, if required

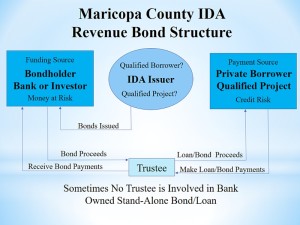

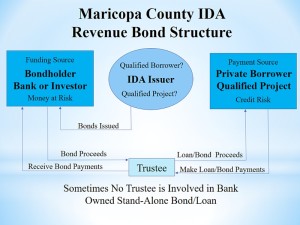

Bond Issue Participants

- Issuer – Political subdivision (Maricopa County IDA) issues bonds to Bondholders (Lenders) who use their own money to lend to the borrower. The Maricopa County IDA has no direct financial responsibility.

- Bondholders must look to borrower’s ability to pay or credit enhancement in event of nonpayment. The Bank may underwrite and privately place loans. (stand-alone loan)

- Borrower – the ultimate user of bond proceeds and obligor. Borrower makes principal and interest payments to bond trustee.

- Underwriter or Placement Agency structures the transaction and prices and sells the bonds to the investors or places the bonds. Banks may privately place bonds (hold for their own account).

- Trustee – Third party commercial bank or trust company to whom Issuer assigns its rights and to whom credit enhancement runs; uses funds from Borrower to pay principal and interest due on bonds to bondholders; and acts on behalf of bondholders to safeguard trust estate.

- Bond Counsel – Prepares bond documents and provides opinion that bonds are validly issued, enforceable, and interest income is tax-exempt to the bondholder.

Christian Care Retirement, Inc. $39,510,000 Bond Refunding

Non-Profits

See more details